lechdvlnie.ru Prices

Prices

How To Sign Up For Google My Business

You can do this by visiting the Google My Business website and create an account. Once you have created an account, you can add your business to. It is a free tool offered by Google that allows businesses to manage their online presence on the Google platform, including Google Search and Google Maps. On your computer, open Google Maps. · In the search bar, enter the business name. · Click the business name and choose the correct one. · Click Claim this business. How to create a Google My Business listing · Visit the Official Website. To start, visit the website, and click the 'manage now' button. · Setting the Name of. If you don't have a Google account, you can create one following this link. Page 2. DISCOVER PUERTO RICO | GOOGLE MY BUSINESS AND HOW TO SIGN UP. At. You can register with Google My Business in just one click when you form your business with us. Then we'll create your profile and verify it with Google within. Get your business on Google for free with Google Business Profile. For questions and discussion about Google Business Profiles (formerly known as Google My Business). sign up for a Google Voice number. 1. Pull up Google Maps. · 2. Right-click anywhere on the page. · 3. Select “Add Your Business.” · 4. Complete your profile. · 5. Verify your business. · Why create. You can do this by visiting the Google My Business website and create an account. Once you have created an account, you can add your business to. It is a free tool offered by Google that allows businesses to manage their online presence on the Google platform, including Google Search and Google Maps. On your computer, open Google Maps. · In the search bar, enter the business name. · Click the business name and choose the correct one. · Click Claim this business. How to create a Google My Business listing · Visit the Official Website. To start, visit the website, and click the 'manage now' button. · Setting the Name of. If you don't have a Google account, you can create one following this link. Page 2. DISCOVER PUERTO RICO | GOOGLE MY BUSINESS AND HOW TO SIGN UP. At. You can register with Google My Business in just one click when you form your business with us. Then we'll create your profile and verify it with Google within. Get your business on Google for free with Google Business Profile. For questions and discussion about Google Business Profiles (formerly known as Google My Business). sign up for a Google Voice number. 1. Pull up Google Maps. · 2. Right-click anywhere on the page. · 3. Select “Add Your Business.” · 4. Complete your profile. · 5. Verify your business. · Why create.

You can easily set it up with your GMB account. Google verifies the profile by either sending a security code at the contact number you feed or by sending a. Google My Business is your business listing on the Google search engine. I call it “GMB” for short. This listing is the lifeblood of any online marketing. Log in to your Google account with your business email domain and then go directly to Google My Business. Enter your company's name, address, industry, location. 1. Create a Google My Business account · 2. Enter your business name · 3. Enter your business address · 4. Select and complete information to appear on Google Maps. To get started, you'll need to provide some basic information about your business, such as your address or service area(s), website URL, phone number, hours of. How to set up Google Business Profile · Step 1: Enter your business name · Step 3: Choose your service area · Step 4: Choose your primary business category · Step 5. How to set up Google Business Profile · Step 1: Enter your business name · Step 3: Choose your service area · Step 4: Choose your primary business category · Step 5. Follow these steps to create a Google account: 1. On the Google account sign-in page, click Create Account. Then, select the type of Google account you want to. If you don't have an account select the button “Create account” and choose the option “To manage my business”. This will take you to the Google Business. This 2 Step Instruction Document is very simple and outlines the exact steps you need to set your GMB up for success. How to create a Google business profile · Step 1: Claim your account · Step 2: Enter the location · Step 3: Enter contact information · Step 4: Verification · Step 5. If you don't already have an account for your business, go to lechdvlnie.ru and select Create account and choose For my work or business from the drop-. Create your profile at no cost, and you can manage your business from Google Search and Maps to start reaching more customers. My business doesn't have a. Step 1: Link Your Google Account · Click Listings in the navigation bar and click All Listings. · Click on the Set up button next to the business you want to set. Can I create my own Google My Business listing? Yes, you can. However, did you set up your own LLC and file your business taxes without an accountant? Most. Create A Google Business Profile (formerly Google My Business) Listing Visit lechdvlnie.ru and select Manage now in the top right-hand corner off the. If you don't have a Google account, you can create one following this link. Page 2. DISCOVER PUERTO RICO | GOOGLE MY BUSINESS AND HOW TO SIGN UP. At. If your business doesn't have a profile yet, you can create one. TELL YOUR STORY. Create a free, professional website. Go to google my business listing page, add your business on google my listing page with all the information, after adding your business done. To qualify for a Google Business Profile, you need to be either a bricks-and-mortar company (like a venue or a gallery), or a service company operating in a.

Monthly House Payment Afford

It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on. There's a lot of work that goes into affording a mortgage payment. For many borrowers, that means creating a budget and eliminating unnecessary monthly expenses. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately. Use our simple mortgage calculator to quickly estimate monthly payments for your new home. This free mortgage tool includes principal and interest. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved for. If you put less than 20% down on a home, your monthly payment will also include private mortgage insurance (PMI) to help protect the lender in case you stop. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on. There's a lot of work that goes into affording a mortgage payment. For many borrowers, that means creating a budget and eliminating unnecessary monthly expenses. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately. Use our simple mortgage calculator to quickly estimate monthly payments for your new home. This free mortgage tool includes principal and interest. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved for. If you put less than 20% down on a home, your monthly payment will also include private mortgage insurance (PMI) to help protect the lender in case you stop. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations.

Your total monthly payment is your monthly obligation on your home. This includes your mortgage payment, property taxes, and home insurance — plus homeowners. Those include a steady income, adequate savings for the down payment and closing costs, the amount of debt you carry, and your repayment history. However, the. To calculate your DTI ratio, divide your monthly debt payments by your monthly gross income and multiply by For example, if you pay $2, toward your debt. Based on information provided, you may be able to afford a home worth up to $, with a total monthly payment of $1, ; LOAN & BORROWER INFO. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. If you want to play it safe, stick to the 28/36 rule, and make sure your monthly mortgage payment exceeds no more than 28% of your monthly gross income. As you. Your mortgage payment should be 28% or less. Your debt-to-income ratio (DTI) should be 36% or less. Your housing expenses should be 29% or less. How to lower your monthly mortgage payment · Choose a longer loan. With a longer term, your payment will be lower (but you'll pay more interest over the life of. Industry standards suggest your total debt should be 36% of your income and your monthly mortgage payment should be 28% of your gross monthly income. Learn more. Gross annual income? Monthly debt payments? Down payment funds? How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. Lenders call this the. “front-end” ratio. In other words, if your monthly gross income is $10, or $, annually, your mortgage payment should be $2, Next, divide by your monthly, pre-tax income. To get a percentage, multiple by The number you're left with is your DTI. Down Payment. Many mortgage lenders. Lenders divide your total monthly debt payments by your income to determine whether or not you can afford another loan. The higher your down payment, the. If you want monthly payment and a k house, you need to put at least % down. If I were you I wouldn't be comfortable buying k. Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. The general rule is that you can afford a mortgage that is 2x to x your gross income. · Total monthly mortgage payments are typically made up of four.

How Do You Dispute Something Off Your Credit

What you should do is contact the credit bureaus were the account appears, and ask them to investigate the account, and make sure it is %. You have the right to dispute any inaccuracies in your credit reports. Once you challenge an item in a report, the credit reporting agency must either. File a dispute for free with the three nationwide credit bureaus. It's important to remember that disputing information with one credit bureau may not impact. Most of the time, in order to be able to remove a disputed collection from your report, the credit reporting agency needs to see proof that the collection. Debtors must directly contact credit reporting agencies to discuss how long a bankruptcy case remains on a credit report. If your credit reports contain errors or outdated information, here's how to dispute those items with the credit reporting bureaus. Your credit reports can. Learn more about how to dispute a credit report. You can file a dispute if you believe your TransUnion credit report contains inaccurate information. If your dispute is successful, the credit bureaus will remove or correct the inaccurate information on your credit report. This may have an immediate. Fixing credit report errors · Clearly identify each disputed item in your report. · State the facts and explain why you dispute the information. · Request deletion. What you should do is contact the credit bureaus were the account appears, and ask them to investigate the account, and make sure it is %. You have the right to dispute any inaccuracies in your credit reports. Once you challenge an item in a report, the credit reporting agency must either. File a dispute for free with the three nationwide credit bureaus. It's important to remember that disputing information with one credit bureau may not impact. Most of the time, in order to be able to remove a disputed collection from your report, the credit reporting agency needs to see proof that the collection. Debtors must directly contact credit reporting agencies to discuss how long a bankruptcy case remains on a credit report. If your credit reports contain errors or outdated information, here's how to dispute those items with the credit reporting bureaus. Your credit reports can. Learn more about how to dispute a credit report. You can file a dispute if you believe your TransUnion credit report contains inaccurate information. If your dispute is successful, the credit bureaus will remove or correct the inaccurate information on your credit report. This may have an immediate. Fixing credit report errors · Clearly identify each disputed item in your report. · State the facts and explain why you dispute the information. · Request deletion.

You also can take your complaints to those responsible for supplying information to the credit bureaus: banks, retailers, mortgage companies — in short, anyone. Submit a Dispute to the Credit Bureau · Dispute With the Business That Reported to the Credit Bureau · Send a Pay-for-Delete Offer to Your Creditor · Make a. Generally, it can take several months for an inaccurate item to be removed from your credit report following a dispute. However, the length of time required to. If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished. You may submit a dispute with each of the credit reporting companies over the internet or by mail. Online: Equifax - lechdvlnie.ru 1. Request your credit reports · 2. Review your credit reports · 3. Dispute credit report errors · 4. Pay off any debts. Accurate information cannot be removed from a credit report, even if a dispute is filed. As a lender that furnishes information to credit reporting agencies. It takes at least one month to remove an inaccurate negative entry from your credit report. You must file a dispute with the credit bureaus or creditor, and. If your creditors can back up their claims on any disputed items, the credit bureaus are under no obligation to remove those items, no matter how many disputes. Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be. What you should do is contact the credit bureaus were the account appears, and ask them to investigate the account, and make sure it is %. Ask the credit reporting agency for a dispute form or submit your dispute in writing along with copies of any supporting documents. Keep a copy of what you send. When you submit a dispute, the credit reporting agency must investigate the items in question – usually within. 30 days – unless they consider your dispute. To dispute your Experian credit report, start collecting documents to support your claim. Since you were locked out of identity proo ing in IDM. Page 3. when. If your account is disputed in the Creditor's system, tell the creditor representative: Make a note of the date, time and the person you talked to. Do not. You may use the Federal Trade Commission's sample dispute letter to credit reporting companies and attach a copy of your credit report with the wrong items. Most of the time, in order to be able to remove a disputed collection from your report, the credit reporting agency needs to see proof that the collection. Thanks to the FCRA, you can also dispute collections (or other credit items) that contain errors like incorrect balances, wrong dates and other types of invalid. How To Remove a Charge-Off From Your Credit Reports · 1. Determine the Details of the Debt · 2. Inaccuracies? Dispute Them · 3. Negotiate With the Creditor · 4.

Companies That Offer Ira

Best IRA Companies · Charles Schwab is the leader of the discount brokerage market, offering low-cost options for investors, coupled with robust mobile. You can open an IRA through almost any large financial institution, including banks, mutual fund companies and brokerage firms. Most IRA providers offer a. CD (Time Account) and Savings Account IRAs are available through Wells Fargo Bank, N.A. Deposit products offered by Wells Fargo Bank, N.A. Member FDIC. CalSavers is available to California workers whose employers don't offer a retirement Contributing to a CalSavers IRA through payroll deduction may offer. We offer a wide variety of Traditional and Roth IRA investments, including IRA Savings and IRA Certificates that ensure guaranteed growth. IRAs can help you save even if you already have a (k) or other workplace retirement account. Each type of IRA offers advantages before and after you retire. Charles Schwab: Charles Schwab offers a wide range of investment options, including commission-free ETFs and mutual funds, making it a great. Savings IRAs from Bank of America and Investment IRAs from Merrill Edge® are available in both Traditional and Roth. Find the IRA that's right for you. You can find self-managed IRAs at online brokers like Fidelity, Charles Schwab, Vanguard, E*Trade, or TD Ameritrade. They're typically used by more active. Best IRA Companies · Charles Schwab is the leader of the discount brokerage market, offering low-cost options for investors, coupled with robust mobile. You can open an IRA through almost any large financial institution, including banks, mutual fund companies and brokerage firms. Most IRA providers offer a. CD (Time Account) and Savings Account IRAs are available through Wells Fargo Bank, N.A. Deposit products offered by Wells Fargo Bank, N.A. Member FDIC. CalSavers is available to California workers whose employers don't offer a retirement Contributing to a CalSavers IRA through payroll deduction may offer. We offer a wide variety of Traditional and Roth IRA investments, including IRA Savings and IRA Certificates that ensure guaranteed growth. IRAs can help you save even if you already have a (k) or other workplace retirement account. Each type of IRA offers advantages before and after you retire. Charles Schwab: Charles Schwab offers a wide range of investment options, including commission-free ETFs and mutual funds, making it a great. Savings IRAs from Bank of America and Investment IRAs from Merrill Edge® are available in both Traditional and Roth. Find the IRA that's right for you. You can find self-managed IRAs at online brokers like Fidelity, Charles Schwab, Vanguard, E*Trade, or TD Ameritrade. They're typically used by more active.

A SIMPLE (Savings Incentive Match Plan for Employees of Small Employers) IRA plan offers great advantages for businesses that meet two basic criteria. 1. Wells Fargo Bank, N.A. ("the Bank") offers various banking, advisory, fiduciary and custody products and services, including discretionary portfolio management. A Roth IRA can be a powerful way to save for retirement as potential earnings grow tax-free. Get Started at Fidelity. Individual Retirement Accounts. Enrolling in an Empower Premier IRA is a simple, straightforward, low-cost way to invest. Plus, it has great tax advantages. The 10 best Roth IRAs · Interactive Brokers · Firstrade Roth IRA · TD Ameritrade Roth IRA · Charles Schwab Roth IRA · Fidelity Roth IRA · Merrill Edge Roth IRA · TIAA. Guideline's full-service (k) plans make it easier and more affordable for growing businesses to offer their employees the retirement benefits they. You can open an IRA on your own through almost any bank, brokerage company, insurance firm, or investment company. And you can save your way for your retirement. Financial trust companies, or independent retirement custodians, that manage large pension funds and alternative assets also offer self-directed IRAs. They hold. Nationwide offers a variety of IRAs to help you save for retirement. Learn about Nationwide IRA interest rates and how to apply for an account today. An Individual Retirement Account (IRA) is a tax-advantaged account that can help you potentially build wealth for retirement more quickly when compared to a. But an employer can help its employees to set up and fund their IRAs. With an IRA, what the employee gets at retirement depends on the funding of their IRA and. bank or other financial institution; life insurance company; mutual fund; stockbroker. Types of IRAs. A traditional IRA is a tax-advantaged personal savings. SIMPLE IRA Providers · Capital Group · Information Not Provided · Charles Schwab · Information Not Provided · E*TRADE · Information Not Provided · Edward Jones. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Fidelity Investments offers Financial Planning and Advice, Retirement Plans, Wealth Management Services, Trading and Brokerage services, and a wide range of. Savings IRAs from Bank of America and Investment IRAs from Merrill Edge® are available in both Traditional and Roth. Find the IRA that's right for you. Nationwide offers a variety of IRAs to help you save for retirement. Learn about Nationwide IRA interest rates and how to apply for an account today. A % reduction in your Merrill Guided Investing management fee · 75% bonus on applicable Bank of America credit card rewards · % discount on auto loan. E*TRADE · US stockbroker · ; Charles Schwab · US discount broker · ; Fidelity · US stockbroker · ; Firstrade · US discount broker · ; Interactive Brokers. Compare Ally Bank IRAs. · View a side-by-side comparison of our Ally Bank IRA accounts. · IRA High Yield CD · IRA Raise Your Rate CD · IRA Savings · Features offered.

Mortgage Broker Real Estate Agent Relationship

Some agents, like Sharon Ayers from Fairfax, have their clients in mind when they say, “I don't want to know more about their finances. Many of my clients are. In an always competitive real estate market, consistent and dependable real estate agent partnerships are invaluable. But forging new relationships or growing. The law says NO. If in the same building, there must be a separate door to the Mortgage Broker's office from the RE Office. A real estate broker or salesperson must tell you who he or she represents in a prospective transaction. This disclosure of the relationship the agent has. When it comes to the home buying and financing industry, independent mortgage brokers and real estate agents are the key players in the business. The agency relationships between mortgage brokers and borrowers and lenders/creditors, or promissory note holders or the intended purchasers of such notes. Although they work in the same industry and serve the same market, real estate agents and mortgage brokers have different duties. In a nutshell, a real estate. All relationships require an investment of time and energy, or they end. Don't pester your referral partners, but don't ignore them either. Call them to check. You can simultaneously hold licenses as a real estate agent and a mortgage loan officer in Illinois. Under certain conditions, you can also. Some agents, like Sharon Ayers from Fairfax, have their clients in mind when they say, “I don't want to know more about their finances. Many of my clients are. In an always competitive real estate market, consistent and dependable real estate agent partnerships are invaluable. But forging new relationships or growing. The law says NO. If in the same building, there must be a separate door to the Mortgage Broker's office from the RE Office. A real estate broker or salesperson must tell you who he or she represents in a prospective transaction. This disclosure of the relationship the agent has. When it comes to the home buying and financing industry, independent mortgage brokers and real estate agents are the key players in the business. The agency relationships between mortgage brokers and borrowers and lenders/creditors, or promissory note holders or the intended purchasers of such notes. Although they work in the same industry and serve the same market, real estate agents and mortgage brokers have different duties. In a nutshell, a real estate. All relationships require an investment of time and energy, or they end. Don't pester your referral partners, but don't ignore them either. Call them to check. You can simultaneously hold licenses as a real estate agent and a mortgage loan officer in Illinois. Under certain conditions, you can also.

Throughout the home buying process communication is key. A mortgage broker and real estate agent who have a good communication system and have worked well. We all know the REALTOR and Mortgage broker relationship goes hand-in-hand. Which is why I invite you to engage with me in co-marketing opportunities. A real estate brokerage firm is the agent of a buyer, seller, landlord, or tenant, and the real estate brokerage firm's "associated licensees" are its subagents. In an agency relationship, a broker is referred to as an "agent" and the seller/landlord and buyer/tenant is referred to as the "principal." For simplicity, in. Affiliated Business Arrangements · Real estate brokers and agents are permitted to own an interest in a settlement service company, such as a mortgage brokerage. Alice, The Real Estate Agent · Linda, The Loan Officer or Mortgage Broker · Pat, The Loan Processor · Nick, The Underwriter · Fred, The Appraiser · Herman, The Truth. When clients see a harmonious relationship between their real estate agent and mortgage broker, it instils a sense of confidence in the. Most mortgage companies will not hire dually licensed realtors with an NMLS mortgage loan originator license. It just does not make sense why most lenders will. Agents can't earn fees for referring buyers unless they become licensed loan officers themselves, which is very rare. Referring exclusively to one lender is. The relationship between a mortgage broker and a real estate agent shouldn't be transactional but rather a long-term partnership. This enduring collaboration. Loan officers and real estate agents have a relationship that naturally lends itself to a promotional partnership for several reasons. They share a common goal. Many real estate agents and brokers remain eager to work closely with banks, non-bank lenders and mortgage brokers, especially if the relationship is a good. Unlike real estate agents, brokers can work independently and start their own brokerage and hire other real estate agents. What Do Real Estate Brokers Do? Real. Be honest. Real estate agents understand that not every lender can originate every loan. If an agent provides a loan scenario to you, don't automatically say. As a loan officer, you understand the importance of a strong realtor relationship. If they don't know who you are or have not actively worked to create a. They help individuals and businesses secure loans to fulfill their real estate dreams. However, when it comes to representing the best interests of both the. In the dynamic world of real estate, collaboration between mortgage brokers and real estate agents can yield significant benefits. (10) "Dual agent" means a broker who simultaneously has a client relationship with both seller and buyer or both landlord and tenant in the same real estate. The short answer is “yes”. Real estate agents, lawyers and mortgage specialists are con- stantly discussing the trans- action and obtaining needed.

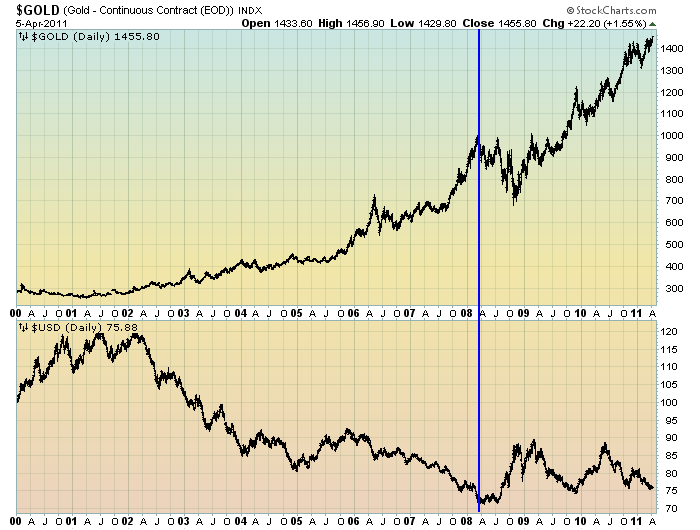

Gold Price America

Today's Gold Price in US = USD / 1 Gram · 1 gram · 8 gram · gram · 1 Ounce · 1 Kilogram · 1 Soveriegn · 1 Tola grams. XAUUSD: Live Gold Spot price with today's current US Dollar rate. Track historical rates, news, analysis as well as charts. Live Gold Spot Prices ; Gold Prices Per Ounce, $2, + ; Gold Prices Per Gram, $ + ; Gold Prices Per Kilo, $82, + The gold premium will vary depending on the dealer, but a reputable gold dealer will not charge a high premium for the sale of gold coins or gold bullion. This. Live Gold Spot to US Dollar rate. Free XAU USD chart with historical data. Top trading ideas and forecasts with technical analysis for world currencies. gold price per troy ounce in U.S. dollars (USD). One can, however, get the price of gold per gram or kilo, as well. What does the "gold spot price" mean? Gold Price in USA ; Today 22 Carat Gold Price Per Gram in United States (USD) · · ; Today 24 Carat Gold Rate Per Gram in United States (USD) · 83 · Track the live price of gold using our real time gold price chart in US dollars. Multiple currencies and time frames are available. The price of gold today, as of am ET, was $2, per ounce. That's up % from yesterday's gold price of $2, Compared to last week, the price of. Today's Gold Price in US = USD / 1 Gram · 1 gram · 8 gram · gram · 1 Ounce · 1 Kilogram · 1 Soveriegn · 1 Tola grams. XAUUSD: Live Gold Spot price with today's current US Dollar rate. Track historical rates, news, analysis as well as charts. Live Gold Spot Prices ; Gold Prices Per Ounce, $2, + ; Gold Prices Per Gram, $ + ; Gold Prices Per Kilo, $82, + The gold premium will vary depending on the dealer, but a reputable gold dealer will not charge a high premium for the sale of gold coins or gold bullion. This. Live Gold Spot to US Dollar rate. Free XAU USD chart with historical data. Top trading ideas and forecasts with technical analysis for world currencies. gold price per troy ounce in U.S. dollars (USD). One can, however, get the price of gold per gram or kilo, as well. What does the "gold spot price" mean? Gold Price in USA ; Today 22 Carat Gold Price Per Gram in United States (USD) · · ; Today 24 Carat Gold Rate Per Gram in United States (USD) · 83 · Track the live price of gold using our real time gold price chart in US dollars. Multiple currencies and time frames are available. The price of gold today, as of am ET, was $2, per ounce. That's up % from yesterday's gold price of $2, Compared to last week, the price of.

Gold Price in US Dollars is at a current level of , down from the previous market day and up from one year ago. This is a change of Live Gold Prices | Price of Gold Per Ounce ; Live Gold Price per Ounce, $2,, ($) ; Live Gold Price per Gram, $, ($) ; Live Gold Price per Kilo. Get Gold / US Dollar Spot (XAU=:Exchange) real-time stock quotes, news, price and financial information from CNBC. BULLION ; American Gold Eagle (% pure gold), $2,/oz ; American Gold Buffalo (% pure gold), $2,/oz ; 1 oz Recognized Gold Bar, $2,/oz ; 5. Gold Spot Price ; Gold Price Per Gram. $ USD, - ($) USD ; Gold Price Per Kilo. $83, USD, - ($) USD ; Live Metal Spot Prices (24 Hours) Last. You can access information on the Gold price in British Pounds (GBP), Euros (EUR) and US Dollars (USD) in a wide variety of time frames from live prices to all. Gold Coins ; American Gold Buffalo (% pure gold), $3,/oz ; American Gold Eagle (% pure gold), $3,/oz ; Austrian Ducat (% pure gold). On this page you can view the current price of gold per ounce, gram or kilo. Gold is usually quoted by the ounce in U.S. Dollars. The gold price can. We have especially strong bids for old US gold coins. lechdvlnie.ru is owned & published by CMI Gold & Silver Inc. Copyright – CMI Gold & Silver Inc. All rights. Featured Categories ; Gold Sovereign · $ ; Gold Britannia 1oz · $2, ; 1 Ounce Gold Bars · $2, ; Gram Gold Bars · $8, Gold Sovereign · $ ; Gold Britannia 1oz · $2, ; 1 Ounce Gold Bars · $2, ; Gram Gold Bars · $8, On this page you can view the current price of gold per ounce, gram or kilo. Gold is usually quoted by the ounce in U.S. Dollars. The gold price can. Gold prices today ; US Dollar (USD), , $2,, $82,, $ ; British Pound (GBP), , £1,, £63,, £ View an interactive gold price chart to see gold prices today and throughout history. Learn how to buy gold from U.S. Money Reserve! Gold Price Performance USD ; 10 Gram Gold Bar Fine Gold; New with Assay; IRA Eligible ; 1/2 oz Gold Eagle. Official US Gold Bullion Coin; Highly Liquid and. Daily Gold price live update. Gold price in US Today (September 15th , Sunday). Find Gold price in USD (Gold in USD). Gold Spot Price ; Gold Price Per Kilo. $83, USD, - ($) USD ; Live Metal Spot Prices (24 Hours) Last Updated: 9/15/ PM ET. lechdvlnie.ru - The No. 1 gold price site for. The price of gold is trading at $, up $ The price of silver is trading at $, up 79 cents. Gold prices reached a record high of $2, per. Taken from Timothy Green's Historical Gold Price Table, London prices converted to. U.S. Dollars. The price of gold remained remarkably stable for long periods.

Should I Roll My Ira Into My 401k

Many people roll over their (k) savings when they change jobs or retire. However, numerous (k) plans allow employees to transfer funds to an IRA while. Note that many types of retirement accounts, not just workplace plans, can be rolled over into an IRA. IRAs may provide a greater variety of investment options. Generally, from a tax perspective, it is more favorable for participants to roll over their retirement plan assets to an IRA or new employer-sponsored plan. In short, even if the recommendation is sound, any financial professional who recommends you move money from the TSP into an IRA could benefit financially from. Generally, from a tax perspective, it is more favorable for participants to roll over their retirement plan assets to an IRA or new employer-sponsored plan. 4. Will taxes be withheld if I roll over my (k) to another qualified retirement plan? You can avoid mandatory tax withholding by requesting a direct. Can I Have a (k) and an IRA at the Same Time? You can contribute to both a (k) and an IRA, though you must stay within the annual contribution limits for. Step 1: Set up your new account · Step 2: Contact your old (k) provider · Step 3: Deposit your money into your Fidelity account · Step 4: Invest your money. If you're switching jobs or retiring, rolling over your (k) to a Traditional IRA may give you more flexibility in managing your savings. Traditional IRAs are. Many people roll over their (k) savings when they change jobs or retire. However, numerous (k) plans allow employees to transfer funds to an IRA while. Note that many types of retirement accounts, not just workplace plans, can be rolled over into an IRA. IRAs may provide a greater variety of investment options. Generally, from a tax perspective, it is more favorable for participants to roll over their retirement plan assets to an IRA or new employer-sponsored plan. In short, even if the recommendation is sound, any financial professional who recommends you move money from the TSP into an IRA could benefit financially from. Generally, from a tax perspective, it is more favorable for participants to roll over their retirement plan assets to an IRA or new employer-sponsored plan. 4. Will taxes be withheld if I roll over my (k) to another qualified retirement plan? You can avoid mandatory tax withholding by requesting a direct. Can I Have a (k) and an IRA at the Same Time? You can contribute to both a (k) and an IRA, though you must stay within the annual contribution limits for. Step 1: Set up your new account · Step 2: Contact your old (k) provider · Step 3: Deposit your money into your Fidelity account · Step 4: Invest your money. If you're switching jobs or retiring, rolling over your (k) to a Traditional IRA may give you more flexibility in managing your savings. Traditional IRAs are.

You can even transfer an existing Rollover IRA into your new Merrill IRA account. Should I rollover my k page or call a Merrill rollover specialist. The Benefits Of Converting Your (k) Into A Rollover IRA · 1) More selection of investments. · 2) Lower costs. · 3) Fewer trading restrictions. · 4) Less tax. Can I roll over a (k) account into a self-directed IRA? Yes. A self-directed IRA gives you the ability to diversify your portfolio with additional. The savings from rolling into a managed Betterment IRA of low-cost exchange-traded funds (ETFs) can add up to a more comfortable retirement. Graph showing. No, there is no good reason to transfer an IRA to a (k). IRAs offer more flexiblity and choice than (k)s. The most obvious is that a (k). You can roll IRA funds into a (k), and there are several reasons to do so. Learn about the limitations and pitfalls before moving forward. How to start the rollover process If you are eligible for a rollover, then a banner should appear at the top of your Guideline dashboard. To get started. The cons: Once you roll your funds into an IRA, they may no longer be eligible for a future rollover into a (k) plan, and RMDs apply at age 73, regardless of. We can help you move over a (k) or other eligible retirement account(s) Can I combine my rollover and annual contributions into a single IRA? Yes. If your new employer doesn't offer a (k), or you don't like their current plan, you can roll your (k) into a traditional IRA or a Roth IRA. Both are. If you roll your (k) money into an IRA, you'll avoid immediate taxes and your retirement savings will continue to grow tax-deferred. · An IRA can also offer. Yes. You can roll over almost any type of employer-sponsored retirement plan, such as a (k), (b), or into a Vanguard IRA. The cons: Once you roll your funds into an IRA, they may no longer be eligible for a future rollover into a (k) plan, and RMDs apply at age 73, regardless of. Can I roll over a (k), (b) or other types of accounts? Yes. You can generally roll over these accounts to TIAA IRAs. IRS rules prevent some specific. Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over all or a portion of the assets to a traditional IRA. So, why roll over your (k) to an IRA? For starters, your previous employer may require it. Or, you may choose to so you have more control over your. I opened a solo k to be able to do employee/employer contributions with my income. I had an old traditional IRA that had money rolled over from an old. If you left a job to become an entrepreneur—or you're not eligible for your new employer's plan—you could roll your (k) into an individual retirement account. To avoid the pro rata rule you need to do a reverse rollover to get the pre-tax IRA into your current k, but depending on the timing you. Moving—or rolling over—your savings from an employer retirement plan into an Individual Retirement Account (IRA) can make growing, managing, and monitoring.

2 3 4 5 6