lechdvlnie.ru Market

Market

Commodities Trader

Book overview Reprint of classic in which legendary futures trader Stanley Kroll describes his trading adventures and discusses philosophy. It is a first. The Commodity Futures Trading Commission (CFTC) protects the public from fraud, manipulation, and abusive practices related to the sale of commodity and. Today's top Commodity Trader jobs in United States. Leverage your professional network, and get hired. New Commodity Trader jobs added daily. Smarter Markets Summer Playlist with guest Hannah Hauman, Global Head of Carbon Trading Trafigura is one of the world's largest suppliers of commodities. Commodities trading is the buying and selling of these raw materials. Sometimes it involves the physical trading of goods. But more often it happens through. Successful commodity traders know the commodity trading secrets and distinguish between trading different types of financial markets. Commodity traders are people or companies who speculate and trade in commodities as diverse as metals and spices. Traders in the corn pit at the Chicago. Commodity trading firms play a pivotal role in the global supply chain by bridging gaps between producers and consumers, and balancing supply and demand. The average trader age is mid-to-late 20s to early 30s. Typically working hours are If you want to go into physical commodity trading the easiest way is. Book overview Reprint of classic in which legendary futures trader Stanley Kroll describes his trading adventures and discusses philosophy. It is a first. The Commodity Futures Trading Commission (CFTC) protects the public from fraud, manipulation, and abusive practices related to the sale of commodity and. Today's top Commodity Trader jobs in United States. Leverage your professional network, and get hired. New Commodity Trader jobs added daily. Smarter Markets Summer Playlist with guest Hannah Hauman, Global Head of Carbon Trading Trafigura is one of the world's largest suppliers of commodities. Commodities trading is the buying and selling of these raw materials. Sometimes it involves the physical trading of goods. But more often it happens through. Successful commodity traders know the commodity trading secrets and distinguish between trading different types of financial markets. Commodity traders are people or companies who speculate and trade in commodities as diverse as metals and spices. Traders in the corn pit at the Chicago. Commodity trading firms play a pivotal role in the global supply chain by bridging gaps between producers and consumers, and balancing supply and demand. The average trader age is mid-to-late 20s to early 30s. Typically working hours are If you want to go into physical commodity trading the easiest way is.

Commodities trading works in the same way as speculating on any other market, in that buyers and sellers come together to exchange goods. The only difference is. Commodities trading offers a way to diversify beyond stocks by buying and selling raw materials such as oil and natural gas, base and precious metals. Castleton Commodities International is a leading Global Energy Commodities Merchant and Infrastructure Asset Investor, unlocking value in Energy markets. JP Morgan's FX, Commodities and Rates Trading Platform on desktop, web, API and mobile. Access fast and reliable electronic market making and order placing. Commodity markets deal in metals (aluminum, copper, gold, lead, nickel, silver, zinc, etc.) and “soft” items (cocoa, coffee, sugar, oil, etc.). StoneX utilizes physical commodity trade to provide forward pricing and supply chain management services that allow clients to mitigate price risk and manage. As an international commodity trading company, we have brought together exceptional individuals with diverse global backgrounds and decades of experience. Apply relevant commodity trading strategies to guide trade positions during various market trends or economic conditions. Build good business relationships with. Technical Analysis of Stocks & Commodities magazine is the savvy trader's guide to profiting in any market. Every month, we provide serious traders with. Packed with straightforward prose, practical knowledge and honest counsel, Diary of a Professional Commodity Trader delivers far more than the title promises. The term “commodities trader” means any person who is a member (or, except as otherwise provided in regulations, is entitled to trade as a member) of a. Optiver is looking for a Commodity Trader to join our growing Singapore office in the Commodities trading team. A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. commodities, and market conditions. Sample of reported job titles: Broker, Commodities Broker, Equity Trader, Financial Advisor, Financial Consultant. Trading Economics provides data for several commodities including live bid/ask quotes, last trading prices, forecasts, charts with historical time series. A commodity trading advisor (CTA) is an individual or organization that, for compensation or profit, advises others, directly or indirectly. Commodity trading is the process of buying, transporting, storing, transforming and/or selling physical commodities, as well as managing assets. It is common practice for most commodity traders to have a bachelor's degree in business, international business, finance, economics or accounting in order to. Commodity trading firms play a pivotal role in the global supply chain by bridging gaps between producers and consumers, and balancing supply and demand. commodities. For one of the reports, Traders in Financial Futures, traders are classified in the same category for all commodities. Due to legal restraints.

How Do I Start A Llc Business

If business entities could avoid business income taxes simply by forming in Nevada or Wyoming, then everyone would form their businesses there. We highly. You don't need an LLC to start a small business, but with their asset protection and flexible tax options, LLCs are more popular than ever with business. A Limited Liability Company (LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your state. Choose your LLC business name. Choose your registered agent. Obtain any necessary licenses or permits. File your articles of organization. Obtain an employer. Starting a business requires a great deal of planning and work. While this guide will serve as a big help, it does not constitute legal advice. If you have. Business Name · Oklahoma. Filing a Trade Name with the ; Business Licenses + Permits · Sales Tax Permit · Obtain a sales tax permit from the ; Employer. Choose a Business Name: · File Formation Documents: · Obtain a Business Number: · Obtain Required Business permit and licenses: · Open a Corporate Bank Account. In some states, once your application has been received, the state agency may issue a certificate of approval within just three business days. Other states may. To form an LLC in California, go to lechdvlnie.ru, log in, select Register a Business under the Business Entities Tile, Articles of Organization - CA. If business entities could avoid business income taxes simply by forming in Nevada or Wyoming, then everyone would form their businesses there. We highly. You don't need an LLC to start a small business, but with their asset protection and flexible tax options, LLCs are more popular than ever with business. A Limited Liability Company (LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your state. Choose your LLC business name. Choose your registered agent. Obtain any necessary licenses or permits. File your articles of organization. Obtain an employer. Starting a business requires a great deal of planning and work. While this guide will serve as a big help, it does not constitute legal advice. If you have. Business Name · Oklahoma. Filing a Trade Name with the ; Business Licenses + Permits · Sales Tax Permit · Obtain a sales tax permit from the ; Employer. Choose a Business Name: · File Formation Documents: · Obtain a Business Number: · Obtain Required Business permit and licenses: · Open a Corporate Bank Account. In some states, once your application has been received, the state agency may issue a certificate of approval within just three business days. Other states may. To form an LLC in California, go to lechdvlnie.ru, log in, select Register a Business under the Business Entities Tile, Articles of Organization - CA.

To organize online, the LLC must meet the following requirements: Limited Liability Company Name The name must include one of the following. You can form it via your business state secretary of state website. But if you must use an agent, I'll recommend Northwest Registered Agent, I'. Our website is open to everyone to search and view business records. The public will be able to see any information or documents you provide for the LLC. Your Florida LLC's articles can be filed online at lechdvlnie.ru, or you can print the state form from the Florida Division of Corporation's website and mail it in. Decide on a business name · Determine your management structure · Designate a registered agent for your LLC · File articles of organization · Forming an LLC online involves filing a document called the Articles of Organization with your state's Secretary of State. Because of regional differences, the. When should I use this application? When you want to start a new business in the state of NJ (LLC, PA, DP, Non-Profit, etc); When you need to authorize a. Online filing of a certificate of formation is provided through SOSDirect. The limited liability company (LLC) is not a partnership or a corporation but. Decide on a business name. Determine your management structure. Designate a registered agent for your LLC. SOLE PROPRIETORSHIP? GENERAL PARTNERSHIP? CORPORATION? S-CORPORATION? LIMITED LIABILITY COMPANY? NONPROFIT CORPORATION? LIMITED PARTNERSHIP? LIMITED. Choose a name for your LLC · Choose a registration agent · Obtain your EIN and check tax requirements · Prepare an LLC operating agreement · Open a bank account for. 1/ What is an LLC? A Limited Liability Company (LLC) is a business structure allowed by state statute. Most states permit “single-member” LLCs. Form an LLC online in minutes with CorpNet. Our filings experts can prepare and file your Limited Liability Company documents within 24 hrs. Start a Business · Start E-Filing; Limited Liability Company To create a Florida limited liability company (LLC) OR correct your rejected online filing. Review common business structures · Sole proprietorship · Partnership · Limited liability company (LLC) · Corporation · Cooperative. Get Prepared. Do your research to be sure an LLC is the right structure for your business entity. · Gather What You'll Need. Name of the LLC or a valid name. Create a new, domestic business and choose "Domestic Limited Liability Company." Fill out the required information about your business entity. Pay the $ LLC Registration/Business License · Employer Identification Number · Business Bank Account · Bookkeeping and Taxes · Business Insurance · Operating Agreement. Create your LLC with Nolo · Choose a Name for Your LLC · Appoint a Registered Agent · File Your Articles of Organization · Decide Whether Your LLC Should Be Member-. There are several business structures to choose from, including sole proprietorship, partnership, corporation, limited liability company and limited liability.

Banks That Deposit Paychecks Early

The only thing better than payday is early payday! With Associated Bank's Early Pay you can get your money up to two days early! With direct deposit, you got it. How to make early payday happen. · 1. Open a Varo account. step-2 · 2. Turn on direct deposit. step-3 · 3. Get paid up to 2 days early.¹. Early Pay grants access to your direct deposit up to two days prior to the scheduled payment date. Early availability of your paycheck is based on the timing of. Get Paid Up to Two Days Early With Early Pay!* If you already have direct deposit established, no extra signup is necessary! Your direct deposit may. Early Pay allows you access to your eligible direct deposit up to two days early. No enrollment required – Early Pay is included with direct deposit. Early direct deposit services can allow customers to receive their direct deposits, such as their paycheck, up to two business days early. Banks do this by. Get access to qualifying payroll funds from participating employers or federal and state government payments up to two days early with Early Pay. If you have a Dollar Bank personal checking or savings account, you can receive your direct deposits up to two business days earlier than the standard deposit. Get your money faster with early direct deposit. Set up direct deposit and get that “just paid” feeling up to two business days early with Chase Secure. The only thing better than payday is early payday! With Associated Bank's Early Pay you can get your money up to two days early! With direct deposit, you got it. How to make early payday happen. · 1. Open a Varo account. step-2 · 2. Turn on direct deposit. step-3 · 3. Get paid up to 2 days early.¹. Early Pay grants access to your direct deposit up to two days prior to the scheduled payment date. Early availability of your paycheck is based on the timing of. Get Paid Up to Two Days Early With Early Pay!* If you already have direct deposit established, no extra signup is necessary! Your direct deposit may. Early Pay allows you access to your eligible direct deposit up to two days early. No enrollment required – Early Pay is included with direct deposit. Early direct deposit services can allow customers to receive their direct deposits, such as their paycheck, up to two business days early. Banks do this by. Get access to qualifying payroll funds from participating employers or federal and state government payments up to two days early with Early Pay. If you have a Dollar Bank personal checking or savings account, you can receive your direct deposits up to two business days earlier than the standard deposit. Get your money faster with early direct deposit. Set up direct deposit and get that “just paid” feeling up to two business days early with Chase Secure.

WSFS Bank now has Early Pay, which allows Customers to receive eligible direct deposits from their employers up to two days early. 32 Best Banks With Early Direct Deposit ; Golden 1 Credit Union, Paycheck up to two days early ; GO2Bank, Paycheck up to two days early ; Guaranty, Paycheck up to. Get paid up to two days faster with Porte! With Direct Deposit, your paycheck is available to you as soon as the bank receives it. Get started today! That's why City National Bank offers Early Pay! Early Pay gives you access to your direct deposit from an employer or government agency up to a full day early. We're giving you the power to get paid early—up to 2 days sooner! Signing up for direct deposit so you can enjoy early paycheck with Checking is easy. Get your paycheck sooner with Direct Deposit Early Pay. Through our continued efforts to update and invest in tools and services that make our customers'. Why Wait for Payday? Equity Bank is proud to unveil EarlyPay! Now, customers can receive direct deposits hours earlier in their primary checking. Early Pay is a free service that Huntington provides its checking customers; giving customers access to their pay up to two days early. Set up direct deposit to automatically get your paycheck up to two days early every time you get paid.* Once the money hits your account, you can start paying. Set up direct deposit into your CUTX checking account and get your money up to two days before your normal payday. Get paid up to 2 days early when you have a Citizens personal checking, savings or Money Market account set up with direct deposit! Mostly credit unions. I have USAA and get my check deposit showing up Thursday morning instead of Friday. But it's still every 7 days regardless. If you have a KeyBank account with direct deposit, you could receive your pay up to two days early automatically and at no cost. Learn more about KeyBank. Find out how this banking feature works and why some financial institutions now offer it. · A Quick Tutorial on Direct Deposit and Your Paycheck · How does early. Paydays at Gate City Bank can mean cash in your pocket earlier. Receive your paycheck up to two days in advance of your scheduled payday! Some banks, credit unions, and fintech companies offer early direct deposit, which lets members get paid up to two days early. Chime is one such company that. *You may receive a direct deposit up to two days early with Early Pay (5 days for Federal Government. Get Paid Faster with Banks and Credit Unions that Offer Early Direct Deposit Getting your paycheck into your account as soon as possible can be crucial for. If you are a Citizens Personal Checking, Savings or Money Market account customer that has set up a direct deposit with a payor, you may be able to get that. Early Pay gives you access to eligible direct deposits – including paychecks, retirement, and social security – up to two business days sooner.

New Fixed Rate Mortgage

If you're looking for a loan where the monthly principal and interest payment will not change and will be easy to budget, explore a Fixed Rate Loan. You pay a fixed rate for a set time – your mortgage payments won't change until that period ends and you either switch to a new rate or move to our. View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and. A fixed-rate mortgage has an interest rate that does not change throughout the loan's term. Interest rates on adjustable-rate mortgages (ARMs) can increase or. Enjoy a Rate Guarantee. If you are arranging a new mortgage, your fixed interest rate can be guaranteed up to days before the closing date of your home. A fixed-rate mortgage loan is a loan where the interest rate remains the same for the entire term of the loan. Interest rates on fixed-rate mortgages are. With a fixed-rate mortgage, your monthly payment stays the same for the entire loan term. Find information and rates for 15, 20 and year fixed-rate. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Mortgage Rates. The Year Fixed-Rate Mortgage Lingers Just Under Percent. August 22, Although mortgage rates have stayed relatively flat over the. If you're looking for a loan where the monthly principal and interest payment will not change and will be easy to budget, explore a Fixed Rate Loan. You pay a fixed rate for a set time – your mortgage payments won't change until that period ends and you either switch to a new rate or move to our. View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and. A fixed-rate mortgage has an interest rate that does not change throughout the loan's term. Interest rates on adjustable-rate mortgages (ARMs) can increase or. Enjoy a Rate Guarantee. If you are arranging a new mortgage, your fixed interest rate can be guaranteed up to days before the closing date of your home. A fixed-rate mortgage loan is a loan where the interest rate remains the same for the entire term of the loan. Interest rates on fixed-rate mortgages are. With a fixed-rate mortgage, your monthly payment stays the same for the entire loan term. Find information and rates for 15, 20 and year fixed-rate. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Mortgage Rates. The Year Fixed-Rate Mortgage Lingers Just Under Percent. August 22, Although mortgage rates have stayed relatively flat over the.

Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage.

Year Fixed Rate ; Rate: % ; APR: % ; Points.5 ; Estimated Monthly Payment: $1, Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. A fixed rate mortgage is a home loan with an interest rate that remains unchanged over the loan term. This means your monthly mortgage payment (principal and. An adjustable-rate mortgage is a type of loan that carries an interest rate that is constant at first but changes over time. For today, Monday, August 26, , the current average interest rate for the benchmark year fixed mortgage is %, down 7 basis points over the last seven. 5-year fixed mortgage rates are the most popular type and term combination in Canada. Compare the best 5-year fixed rates in Canada with us! View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. A fixed-rate mortgage has an interest rate that does not change throughout the loan's term. Interest rates on adjustable-rate mortgages (ARMs) can increase or. Enjoy a Rate Guarantee If you are arranging a new mortgage, your fixed interest rate can be guaranteed up to days before the closing date of your home. If. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Today's Rate on a Year Fixed Mortgage Is % and APR % · Take a look at our Mortgage Payment Calculator and learn how much home you can afford! A year fixed-rate mortgage is the most common mortgage loan option. It has a repayment period of 30 years and the interest rate doesn't change throughout the. A fixed rate mortgage is a reliable option because it offers predictable monthly payments. The mortgage interest rate is consistent for the life of the loan. Additionally, the current national average year fixed mortgage rate decreased 3 basis points from % to %. The current national average 5-year ARM. A fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. · Once locked in, the interest rate does not fluctuate with. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. What is a fixed-rate mortgage? A fixed-rate mortgage has an interest rate that remains the same for a set period – typically up to five years, but sometimes. Key Features: · Interest rate is fixed at inception and during the construction period · Interest-only payments during construction up to 12 months · Fixed rate. year Fixed-Rate Mortgage Requirements · A minimum credit score of to Having a good credit score is the main way borrowers are able to qualify for.

Carmax Or Carvana To Buy A Car

The differences in buying or selling a car online with Beaver Toyota Dealership vs. Carvana, CarMax, or Vroom is significant. Learn more today! I'd say go with the best price from Carmax or Carvana. For the big dealerships that are countrywide, they are pretty safe but inflexible and. The quality of the car is better at car max. Both companies have a reconditioning process, however Carmax does a better job. CarMax vs Carvana Stock: CarMax Is the Walmart of used car sales with a massive footprint while Carvana is an online portal to buy cars. Carvana. Used Cars Guide · Flexibility. When you buy a used car instead of a new one, it's important to be flexible about what you want and what's most important. M posts. Discover videos related to Carmax Vs Carvana on TikTok. See more videos about Carmax Buying Experience, Discontinued Cars, Carmax Auctions. In these unprecedented times having a car dealer you can count on and trust is more important than ever before. Buying or leasing a newer vehicle is likely. For example, Carvana, one of the largest used car dealers in the United States makes more than 50% of their gross profit per vehicle sold on the “back-end” of. However, CarMax is priced higher at percent, while Carvana is percent. Best Deals at Carmax. iSeeCars looked at CarMax used car inventory to see which. The differences in buying or selling a car online with Beaver Toyota Dealership vs. Carvana, CarMax, or Vroom is significant. Learn more today! I'd say go with the best price from Carmax or Carvana. For the big dealerships that are countrywide, they are pretty safe but inflexible and. The quality of the car is better at car max. Both companies have a reconditioning process, however Carmax does a better job. CarMax vs Carvana Stock: CarMax Is the Walmart of used car sales with a massive footprint while Carvana is an online portal to buy cars. Carvana. Used Cars Guide · Flexibility. When you buy a used car instead of a new one, it's important to be flexible about what you want and what's most important. M posts. Discover videos related to Carmax Vs Carvana on TikTok. See more videos about Carmax Buying Experience, Discontinued Cars, Carmax Auctions. In these unprecedented times having a car dealer you can count on and trust is more important than ever before. Buying or leasing a newer vehicle is likely. For example, Carvana, one of the largest used car dealers in the United States makes more than 50% of their gross profit per vehicle sold on the “back-end” of. However, CarMax is priced higher at percent, while Carvana is percent. Best Deals at Carmax. iSeeCars looked at CarMax used car inventory to see which.

Carvana. Used Cars Guide · Flexibility. When you buy a used car instead of a new one, it's important to be flexible about what you want and what's most important. buying cars online. Nonetheless, Zackfia is optimistic about online used car dealers, rating CarMax and Carvana Outperform. She writes that in February. Both Carvana and CarMax offer a user-friendly car buying and selling experience. However, Carvana is a better option if you look for convenience and ease of use. Their priority is used cars in good working order. These used cars will go on to make up their stock for drivers just like yourself to buy. · They provide trade-. Their priority is used cars in good working order. These used cars will go on to make up their stock for drivers just like yourself to buy. · They provide trade-. Consider MaxCare for long-term reliability and reduced repair costs. Carvana provides basic warranty coverage included with every purchase, suitable for budget-. Reasons why CarMax beat Carvana during my car purchase experience · CarMax has a better web search (and Android app) than Carvana · CarMax has better inventory . Thinking Of Buying A Car From CarMax or Carvana? What's missing? Can You Buy A Certified Pre-Owned Vehicle? Piedmont sells Manufacturer Certified Pre-Owned. Pick up your car at one of our Vehicle Vending Machines and experience the new way to buy a car. Find one near you. Some folks might hesitate to purchase a vehicle online, but CarMax can help quell their anxiety with its “Love it or return it” day money-back policy (with a. Lower Prices. Our prices average about $ less than Carmax and Carvana. We acquire our inventory from the exact same places. To prove that our prices are. Once they inspect your vehicle and make sure it is up to their standards, they will purchase it from you. Meanwhile, when you want to sell your car on Carvana. In the evolving world of automobile sales, Carvana stands out with its entirely online approach to buying and selling cars. Its innovative model, often referred. Carmax and Carvana spend millions on advertising this line: “WE'LL BUY YOUR CAR”. But there is problem with it, according to Nate Mihalovich, CEO of The Lasso. Carvana. Used Cars Guide · Flexibility. When you buy a used car instead of a new one, it's important to be flexible about what you want and what's most important. When deciding between CarMax and Carvana, it's important to consider your personal preferences and the specific needs of your vehicle. Both companies offer. CarMax didn't give away their cars. In fact, their vehicles were nearly always priced higher than similarly-equipped vehicles for sale at franchised dealerships. Find a car you love and do the paperwork online with help from us. Then have it delivered to you or schedule an express pickup at your nearest CarMax store. buying cars online. Nonetheless, Zackfia is optimistic about online used car dealers, rating CarMax and Carvana Outperform. She writes that in February. Consider MaxCare for long-term reliability and reduced repair costs. Carvana provides basic warranty coverage included with every purchase, suitable for budget-.

Tesla Stock Lowest Price

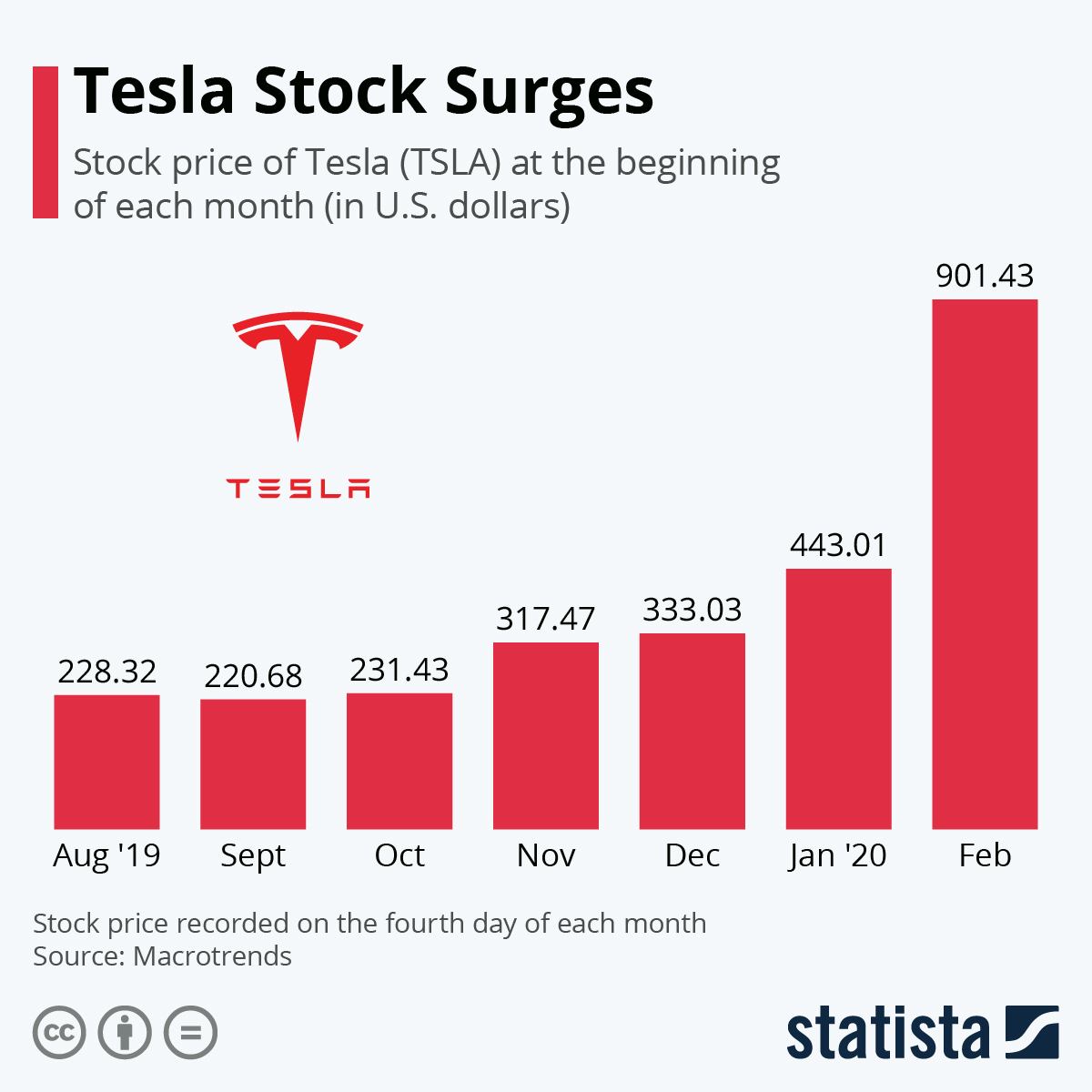

The current price of TSLA is USD — it has increased by % in the past 24 hours. Watch Tesla stock price performance more closely on the chart. US Stock MarketDetailed Quotes. TSLA Tesla. Close Sep 13 ET. + +%. Market CapB. P/E (TTM) High. Low. Discover historical prices for TSLA stock on Yahoo Finance. View daily, weekly or monthly format back to when Tesla, Inc. stock was issued. Historical stock closing prices for Tesla, Inc. (TSLA). See each day's opening price, high, low, close, volume, and change %. Tesla (NASDAQ: TSLA). $ (%). $ Price as of September 13, TSLA - Tesla, Inc. ; Sep 09, , , , , ; Sep 06, , , , , TSLA Historical Data ; Highest: ; Change %. ; Average: ; Difference: ; Lowest: 1-year stock price forecast. High $ % Median $ % Low $ % Current Price past 12 months next 12 months. TSLA Competitors. Tesla Inc TSLA:NASDAQ ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High The current price of TSLA is USD — it has increased by % in the past 24 hours. Watch Tesla stock price performance more closely on the chart. US Stock MarketDetailed Quotes. TSLA Tesla. Close Sep 13 ET. + +%. Market CapB. P/E (TTM) High. Low. Discover historical prices for TSLA stock on Yahoo Finance. View daily, weekly or monthly format back to when Tesla, Inc. stock was issued. Historical stock closing prices for Tesla, Inc. (TSLA). See each day's opening price, high, low, close, volume, and change %. Tesla (NASDAQ: TSLA). $ (%). $ Price as of September 13, TSLA - Tesla, Inc. ; Sep 09, , , , , ; Sep 06, , , , , TSLA Historical Data ; Highest: ; Change %. ; Average: ; Difference: ; Lowest: 1-year stock price forecast. High $ % Median $ % Low $ % Current Price past 12 months next 12 months. TSLA Competitors. Tesla Inc TSLA:NASDAQ ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High

The lowest closing price for Tesla (TSLA) all-time was $, on July 7, The latest price is $

The ratio of current share price to trailing twelve month EPS that signals if the price is high or low compared to other stocks. Dividend yield. The. Tesla Inc. ; Open. $ Previous Close ; YTD Change. %. 12 Month Change ; Day Range · 52 Wk Range. Tesla Inc has a consensus price target of $ based on the ratings of 32 analysts. The high is $ issued by Morgan Stanley on September 5, The low. What is the highest and lowest price Tesla traded in the last 3 year period? In the last 3 years, TSLA stock traded as high as $ and as low as $ The 92 analysts offering price forecasts for Tesla have a median target of , with a high estimate of and a low estimate of This file is Tesla's stock price from initial public offering 06/29/ to 03/17/ calendar_todayDatesort. grid_3x3Opensort. grid_3x3Highsort. grid_3x3Low. Tesla · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. (% YoY). Find the latest historical data for Tesla, Inc. Common Stock (TSLA) at lechdvlnie.ru View historical data in a monthly, bi-annual, or yearly format. Tesla Inc is an American electric-automobile manufacturing company that is listed on the Nasdaq stock exchange since June Compare. Open ; Prior Close (09/12/24). 1 Day; TSLA %; DJIA %; S&P %; Automotive %. Key Stock Data? P/E Ratio (TTM): The Price. Tesla Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time TSLA stock price. Discover real-time Tesla, Inc. Common Stock (TSLA) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. TSLA | Complete Tesla Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Tesla Price: for Sept. 13, · Price Chart · Historical Price Data · Price Definition · Price Range, Past 5 Years · Price Benchmarks · Price Related Metrics. 31 Wall Street analysts offering 12 month price targets for Tesla ; 3 months. The average price target is $ ; $ and a low forecast of $ ; %. New Lows. Period. Made. New low. Percent. From Last. 5-Day, 1. Tesla · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. (% YoY). What happened to Tesla's price movement after its last earnings report? Over the last 12 months, its price fell by percent. Looking ahead, we forecast Tesla to be priced at by the end of this quarter and at in. Tesla's shares closed down $, to $, its lowest close since July 2 and its largest percent decline since Jan. 25, according to Dow Jones Market Data.

How To Pay Off 2 000 Credit Card Debt

There are two primary methods that people use to pay off their debts — snowball and avalanche. Both methods first require you to pay the minimum. If you have extra money in savings, consider whether it's worth using any of it to pay down debt. The interest you need to pay on your credit card debt is. Consolidate debt · Transfer balances. Take advantage of a low balance transfer rate to move debt off high-interest cards. · Tap into your home equity. If you have. Use this calculator to determine how long it will take you to payoff your credit cards if you only make the minimum payments. Prioritizing the repayment of high-interest debt is a key strategy for paying off debt efficiently. High-interest debt, such as credit card or payday loans, can. Use this calculator to see what it will take to pay off your credit card balance, and what you can change to meet your repayment goals. Pay off the card with the smallest balance and then apply what is left to the next one. The road out of debt is to take care of your debts one. Strategies for paying off credit card debt · Debt avalanche method: This method, also known as the highest interest rate method, involves identifying debts with. This means you could transfer your credit card debt and not have to deal with interest for several months or even a year (depending on the card). While our. There are two primary methods that people use to pay off their debts — snowball and avalanche. Both methods first require you to pay the minimum. If you have extra money in savings, consider whether it's worth using any of it to pay down debt. The interest you need to pay on your credit card debt is. Consolidate debt · Transfer balances. Take advantage of a low balance transfer rate to move debt off high-interest cards. · Tap into your home equity. If you have. Use this calculator to determine how long it will take you to payoff your credit cards if you only make the minimum payments. Prioritizing the repayment of high-interest debt is a key strategy for paying off debt efficiently. High-interest debt, such as credit card or payday loans, can. Use this calculator to see what it will take to pay off your credit card balance, and what you can change to meet your repayment goals. Pay off the card with the smallest balance and then apply what is left to the next one. The road out of debt is to take care of your debts one. Strategies for paying off credit card debt · Debt avalanche method: This method, also known as the highest interest rate method, involves identifying debts with. This means you could transfer your credit card debt and not have to deal with interest for several months or even a year (depending on the card). While our.

If you're not planning to consolidate your credit card balances (see below for more), there are two approaches you can use: the debt snowball method and the. Tips for paying off debt · Pay more than the lechdvlnie.ru · Pay more than once a lechdvlnie.ru · Pay off your most expensive loan lechdvlnie.ru · Consider the. So, take a look at your budget and bank statements and calculate how much money you're spending monthly to pay down debt. If that amount is greater than 10%. 2. Debt Avalanche The debt avalanche method is like the snowball method, except you focus on paying off your highest interest rate card first while paying the. The least aggressive debt payoff method is making only the minimum payments. Experts advise you only pay the minimums when your main goals are to keep your. How can I pay off my credit card debt? · Pay it back gradually · Try to pay at least the minimum payment if you can. · Plan your spending · Make a budget plan. You. With no emergency savings to draw on during a crisis, you may have to rely on a high-interest credit card or a personal loan to cover the costs. To avoid. If you are confident you are ready to turn the corner on financial responsibility, a DIY debt management plan is a great way to prove it. There are two popular. 1. Set a Goal Start by Setting a Goal You Can Achieve · 2. Put Your Credit Cards on Ice Yes, We Mean That Literally · 3. Prioritize Your Debts · 4. Trim Your. “To determine whether you can pay off credit card debt in a particular time frame, use a debt repayment calculator like this one by Credit Karma,” says Holden. 1. Pay more than the minimum · 2. Choose a payoff strategy · 3. Consider consolidation · 4. Use a balance transfer card · 5. Seek credit counseling. The two methods are similar in that the first priority is always to meet the minimum payments due for each credit card in order to avoid hefty fees. After this. I developed a debt payoff plan. I used the snowball method, where you pay off your smallest debt balances first while making minimum payments on the larger ones. 1. Contact your credit card companies · 2. Understand the two ways to pay off credit card debt · 3. Consider a debt management plan · 4. Participate in credit. 1. Create a budget and track your income and spending · 2. Be mindful of debt fatigue · 3. Prioritize paying high-interest debt first · 4. Get a higher-paying new. Tips for How to Pay Off Debt & Save on Interest · Catch Up on Past-Due Bills. · Build an Emergency Fund. · Make a Budget. · Consider a Balance Transfer Credit Card. Some creditors will accept a 'full and final settlement'. This is when you pay off debts less that the total owed. You will need to have the money so you can. No one enjoys being in debt, but it is a place we all seem to find ourselves at certain points in our lives. By making a plan for consistent monthly payments. 1. Stop Using Your Cards! · 2. See if You Can Cut Your Credit Card Interest Rate by 70% · 3. Use a Credit Card With No Balance for Normal Purchases · 4. Budget. Increase your debt payments: You're also not likely to make progress on a large credit card balance without paying more than the minimum payment. See where you.

Meaning Of Indemnity

Indemnity means protection against, or compensation for, a loss or liability. Some indemnity claims arise by operation of law. Find the legal definition of INDEMNITY from Black's Law Dictionary, 2nd Edition. An Indemnity Is a collateral contract or assurance, by which one person. protection against damage or loss, especially in the form of a promise to pay for any damage or loss that happens. indemnity - Protection provided against any potential harm, loss, or damage. 1(law) [uncountable] indemnity (against something) protection against damage or loss, especially in the form of a promise to pay for any that happens an. a and i - accident - adjustment - anti-indemnity - compensation - contract bond - double indemnity - indemnification - indemnify - indemnitee - indemnitor -. protection against possible damage or loss, especially a promise of payment, or the money paid if there is such damage or loss. In summary, indemnity payments in commercial insurance refer to financial compensation provided by an insurance company to policyholders or affected parties to. In contract law, an indemnity is a contractual obligation of one party (the indemnitor) to compensate the loss incurred by another party (the indemnitee). Indemnity means protection against, or compensation for, a loss or liability. Some indemnity claims arise by operation of law. Find the legal definition of INDEMNITY from Black's Law Dictionary, 2nd Edition. An Indemnity Is a collateral contract or assurance, by which one person. protection against damage or loss, especially in the form of a promise to pay for any damage or loss that happens. indemnity - Protection provided against any potential harm, loss, or damage. 1(law) [uncountable] indemnity (against something) protection against damage or loss, especially in the form of a promise to pay for any that happens an. a and i - accident - adjustment - anti-indemnity - compensation - contract bond - double indemnity - indemnification - indemnify - indemnitee - indemnitor -. protection against possible damage or loss, especially a promise of payment, or the money paid if there is such damage or loss. In summary, indemnity payments in commercial insurance refer to financial compensation provided by an insurance company to policyholders or affected parties to. In contract law, an indemnity is a contractual obligation of one party (the indemnitor) to compensate the loss incurred by another party (the indemnitee).

Indemnity is protection against loss or harm — it is most often used in insurance.

Indemnity can be defined as a contractual obligation to compensate an individual or business for damages or losses they experience. Indemnity is a type of insurance which covers damages or loss in the legal sense. Get indemnity insurance up to Rs. 2 crore from Bajaj Finance with. Where does the noun indemnity come from? The earliest known use of the noun indemnity is in the mid s. OED's earliest evidence for indemnity is from What does indemnity mean? Indemnity is protection or security against damage or loss, or compensation for damages or money spent. Insurance coverage provides. An indemnity agreement is a contract that protects one party of a transaction from the risks or liabilities created by the other party of the transaction. What is 'Indemnity'? Learn more about legal terms and the law at lechdvlnie.ru What's an indemnity plan? Indemnity insurance helps pay medical bills. You may cover some costs yourself first (deductible). After that, you'll share some of. An indemnity is an agreement by one person to bear the cost of certain claims brought against another person in specified circumstances. INDEMNITY meaning: 1: a promise to pay for the cost of possible damage, loss, or injury often used before another noun; 2: a payment made to someone. What Does Indemnity Mean? The word indemnity literally means security, protection or coverage against loss. Indemnity means security or protection against a financial liability. It typically occurs in the form of a contractual agreement made between parties. Indemnity is a type of insurance that covers a wide range of damages and losses. In the indemnity clause, one party commits to compensate another party. To indemnify, also known as indemnity or indemnification, means compensating a person for damages or losses they have incurred or will incur related to a. Indemnity definition: Security against damage, loss, or injury. Indemnity is based on a mutual contract between two parties (one insured and the other insurer) where one promises the other to compensate for the loss against. Indemnity is a specific liability in which a company assumes liability in place of the other party in the event of damages or losses. indemnity. an undertaking by one person to make good losses suffered by another. Frequently confused with guarantee, an indemnity is a primary obligation that. In summary, an indemnity bond is a legal agreement that is used to protect an individual or entity from any potential losses or expenses that may arise from. Indemnity insurance is an agreement wherein one party guarantees Dictionary · Editorial Policy · Advertise · News · Privacy Policy · Contact Us · Careers. Indemnity is a contractual agreement which includes compensation by cash payments, replacement, repairs, or reinstatement.

Can Cbe Group Garnish Wages

Will CBE Group Try Suing Or Garnishing My Wages? CBE Group suing would be a very unlikely situation. In rare cases it may happen, but it certainly isn't the. When I used to work at the IRS at least I could threaten to garnish your wages and put a lien on your property. Debt collectors can't even do. If you don't have a current installment agreement or some other agreed-upon deferral, then yes your wages can be garnished. Stimulus Payments and Bank Account Garnishments Specifically, the IRS has announced that it will be contracting with the following companies for collection. CBE Group · Chicago Acceptance -- auto finance company · Credit Corp Solutions -- debt buyer · Can Debt Collectors Call My Family? McCarthy Burgess & Wolff. The IRS could garnish your wages, take money from your bank accounts, and CBE Group of Cedar Falls, Iowa. Conserve of Fairport, New York. Performant. CBE Group, Inc.: PO Box , Waterloo, IA – Phone: () A PCA cannot take legal action against you if you do not pay your tax bill – only the. Credit card companies typically do not attempt to garnish wages directly. Instead, they sell the debt for a fraction of the cost to a collection agency. The. Wage garnishment is not one of the easiest things to come to terms with, especially if you are in a bad financial situation. However, the law allows a. Will CBE Group Try Suing Or Garnishing My Wages? CBE Group suing would be a very unlikely situation. In rare cases it may happen, but it certainly isn't the. When I used to work at the IRS at least I could threaten to garnish your wages and put a lien on your property. Debt collectors can't even do. If you don't have a current installment agreement or some other agreed-upon deferral, then yes your wages can be garnished. Stimulus Payments and Bank Account Garnishments Specifically, the IRS has announced that it will be contracting with the following companies for collection. CBE Group · Chicago Acceptance -- auto finance company · Credit Corp Solutions -- debt buyer · Can Debt Collectors Call My Family? McCarthy Burgess & Wolff. The IRS could garnish your wages, take money from your bank accounts, and CBE Group of Cedar Falls, Iowa. Conserve of Fairport, New York. Performant. CBE Group, Inc.: PO Box , Waterloo, IA – Phone: () A PCA cannot take legal action against you if you do not pay your tax bill – only the. Credit card companies typically do not attempt to garnish wages directly. Instead, they sell the debt for a fraction of the cost to a collection agency. The. Wage garnishment is not one of the easiest things to come to terms with, especially if you are in a bad financial situation. However, the law allows a.

In turn, that judgment may result in wage garnishment, bank levies, and other serious consequences. If you owe business debts, we can defend you against. Iowa Garnishment Laws: If a creditor obtains a court judgment against a debtor in Iowa, they can garnish the debtor's wages or bank accounts. However, Iowa law. CBE Group. BRANDON BLACK, Consultant/Former Chief. Executive Officer, Encore can and should be improved. Everyone here has. 9 a deep interest in. will be exempt from garnishment by creditors and debt collectors. The CBE Group, Inc., No. cvSCJ (N.D. Ga. May 22, ), the Northern. Having a collections account listed on your credit report can lower your credit score, affecting your ability to secure loans or other financial approvals. Who. If you are considering default, are already in default, or in collections, we can help. CBE Group, Inc., U.S. Department of Treasury Debt Management. companies: Pioneer Credit Recovery, Inc., The CBE Group, Inc. and We do not have the authority to garnish wages, seize property or enter into. CBE Group operates just like any other debt collection agency; by use of all means possible to trace an account holder and request them to pay their overdue. companies: Pioneer Credit Recovery, Inc., The CBE Group, Inc. and We do not have the authority to garnish wages, seize property or enter into. I received a letter in mail from CBE group saying they are a debt collection agency and I owe ebay $ I called ebay and they have no record of it- seems. CBE, ConServe, or Coast garnish your wages, it can still be stressful. You can turn to a tax resolution professional at East Coast Tax Consulting Group. The PCAs are not only tasked with sending letters and making phone calls demanding payment, but they may also send notices of administrative wage garnishments. Debt collectors can only take money from your paycheck, bank account, or benefits—which is called garnishment—if they have already sued you and a court entered. Collectors threaten to: a. garnish your wages in an amount in excess of 15%; b The CBE Group, Inc. Client Services, Inc. Coast Professional, Inc. The IRS has awarded contracts to 4 agencies currently: Conserve, Pioneer, Performant and CBE Group. garnish wages or collect payment over the phone. CBE P.O. Box The private collection agency can provide information on ways to pay or you can visit Payments for electronic payment options. Stimulus Payments and Bank Account Garnishments Specifically, the IRS has announced that it will be contracting with the following companies for collection. CBE Group, Inc., F. Supp. 2d , (D. Kan. ) ("In this garnish her wages, which it could not do as a matter of law. See 42 Pa. C.S. The CBE Group, Inc. (CBE) is a privately owned company founded in Rehabilitation Program or consolidated their loan could have their wages garnished. If you owe the IRS unpaid taxes, they can take a chunk out of your wages. Find out what to if you're hit with an IRS wage garnishment.

Borrowing Against My Home

An equity loan lets you borrow against the equity in your home · Your home equity can be used instead of a cash deposit to buy an investment property · Investment. The interest paid is usually tax deductible. This type of loan is sometimes referred to as a second mortgage or borrowing against your home. Is a home equity. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. KeyBank can help you attain them with a home equity loan. Our loans let you borrow against the equity in your home with a fixed rate and term. A home equity loan is just a mortgage, which helps you finance the purchase of a house. Unless you've got tons of cash at the ready as an. Key takeaways · Home equity line of credit (HELOC). This is a line of credit backed by a residential property that already has a mortgage on it, usually your. As you repay your outstanding balance, the amount of available credit is replenished – much like a credit card. This means you can borrow against it again if. An equity loan lets you borrow against the equity in your home · Your home equity can be used instead of a cash deposit to buy an investment property · Investment. Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways people use a home as collateral for home. An equity loan lets you borrow against the equity in your home · Your home equity can be used instead of a cash deposit to buy an investment property · Investment. The interest paid is usually tax deductible. This type of loan is sometimes referred to as a second mortgage or borrowing against your home. Is a home equity. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. KeyBank can help you attain them with a home equity loan. Our loans let you borrow against the equity in your home with a fixed rate and term. A home equity loan is just a mortgage, which helps you finance the purchase of a house. Unless you've got tons of cash at the ready as an. Key takeaways · Home equity line of credit (HELOC). This is a line of credit backed by a residential property that already has a mortgage on it, usually your. As you repay your outstanding balance, the amount of available credit is replenished – much like a credit card. This means you can borrow against it again if. An equity loan lets you borrow against the equity in your home · Your home equity can be used instead of a cash deposit to buy an investment property · Investment. Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways people use a home as collateral for home.

A home equity loan allows you to borrow a lump sum of money against your home's existing equity. your borrowing history and appraising your home to determine. A home equity loan, which is often referred to as a “second mortgage” or “lien”, allows you to borrow against the equity you've accrued. Home-equity loans and HELOCs are tools for borrowing from your home equity, or the portion of your property you actually own. With a home equity loan, you. Home Equity Loans (HELOANS) and Home Equity Lines of Credit (HELOCs) are two popular financing options that allow you to borrow against the appraised value of. What it is: Just as a bank can allow you to borrow against the equity in your home, your brokerage firm can lend you money against the value of eligible stocks. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. A home equity loan borrows against the equity built in your home. Home equity can be accessed in the form of a loan or a line of credit. If you are a planning a. It's like borrowing against the value your home has gained over time, using it to improve the property further. But remember, it's not risk. lose your home. After you finish this booklet: •. You'll understand the effect of borrowing against your home. •. You'll think through your borrowing and. Freedom Mortgage offers cash out refinances, including cash out refinances on VA and FHA loans. We do not offer home equity lines of credit or home equity loans. As a general rule of thumb, lenders offer loans equal to 80% of your home equity. Your credit history, income, and other financial obligations will also factor. You use your home as collateral when you borrow money and “secure” the financing with the value of your home. This means if you don't repay the financing, the. Access the market value of your home with a BMO home equity loan. Tap All student borrowing optionsExplore your options. Resources. Loan calculators. Hometap provides a loan alternative called a home equity investment, allowing homeowners to tap their home equity without monthly payments. No closing costs · Borrow up to % of your home's equity · Min/Max loan amount: $10, - $, · Fixed rate for the life of the loan · No application or. A home equity loan is just a mortgage, which helps you finance the purchase of a house. Unless you've got tons of cash at the ready as an. Access ongoing cash for a set period of up to 10 years with low minimum payments until your withdrawal period is complete. Contrary to a Home Equity Loan, the. Do you make regular payments on your home mortgage? Or better yet, have you made extra payments along the way? You can borrow against the equity you've. If you've paid off a significant portion of your mortgage, you may be eligible to borrow against that equity using a home equity loan. This can be especially. Refinancing your mortgage can allow you to access available equity by taking cash out. Start with our refinance calculator to estimate your rate and payments.

1 2 3 4 5 6 7